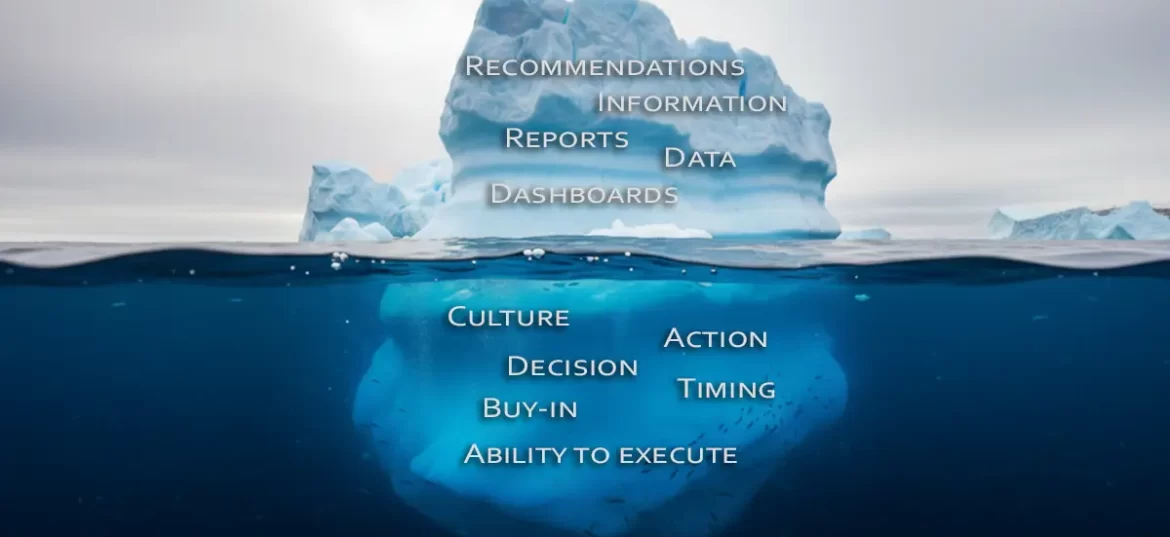

Market and Competitive Intelligence is one of the most powerful tools for reducing uncertainty and driving strategic decisions; however, to be effective, it is essential to overcome resistance, calibrate execution, and gain the trust of decision-makers.

Have you ever heard of an analytical technique called Indicator Monitoring? This Market and Competitive Intelligence (M&CI) method is used alongside Scenario Analysis to identify which projected scenarios are most likely to materialize

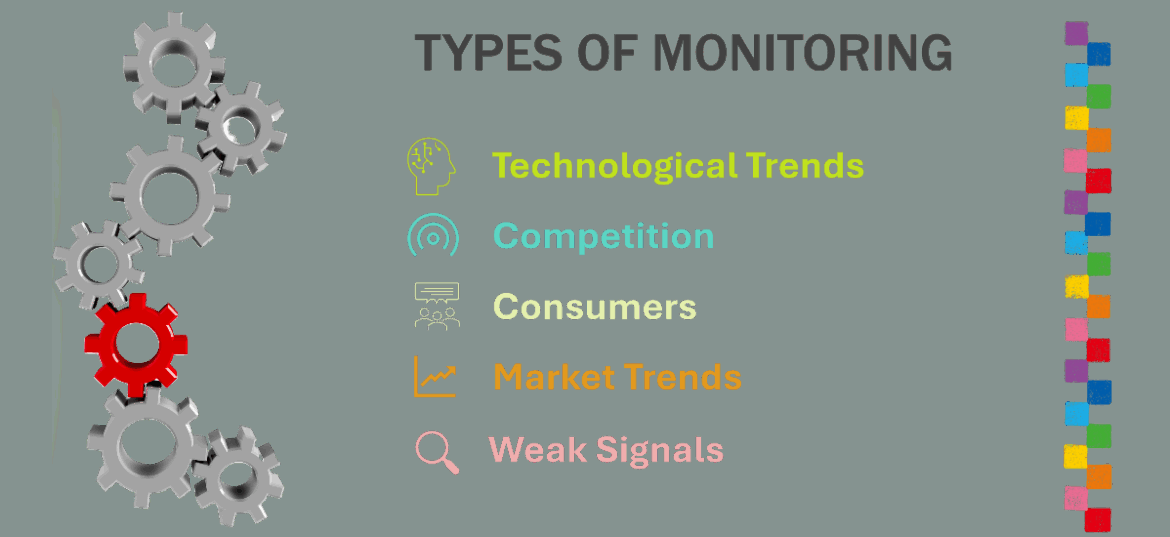

Many business leaders make the mistake of seeing markets as fixed scenarios. They only notice change when it hits their doorstep, disrupting the organization. That’s why forward-thinking companies invest in trend monitoring. Explore the five most common types of monitoring using market and competitive intelligence.

If your company is taking a reactive position in the market, falling behind the competition, or struggling to keep up with changes in the competitive landscape, it’s time to consider Market and Competitive Intelligence as a potential solution.

One of the exercises we do before any project here at Link is to understand the information needs of each client. Conceptually, it seems like something simple to define, especially if there’s a clear problem to solve using Market and Competitive Intelligence (M&CI), such as launching a product or entering a new market.

We have frequently worked with clients operating in commoditized or nearly saturated markets. Typically, in saturated segments, customers readily change suppliers and look for the lowest prices. Consistently, a competitor will begin a price war, compressing margins for all market players. Businesses facing this situation must reinvent themselves and pursue differentiation. Market and Competitive Intelligence (M&CI) provides several alternatives that can help shift the balance in your favor.