In a world where change is the only constant, the ability to make fast decisions is a skill leaders must continuously develop. However, there is not always clarity or certainty about which path to take, and it becomes necessary to gather information about the market environment, competitors, customers, trends, and more. Yet hesitation can be as harmful as making the wrong decision.

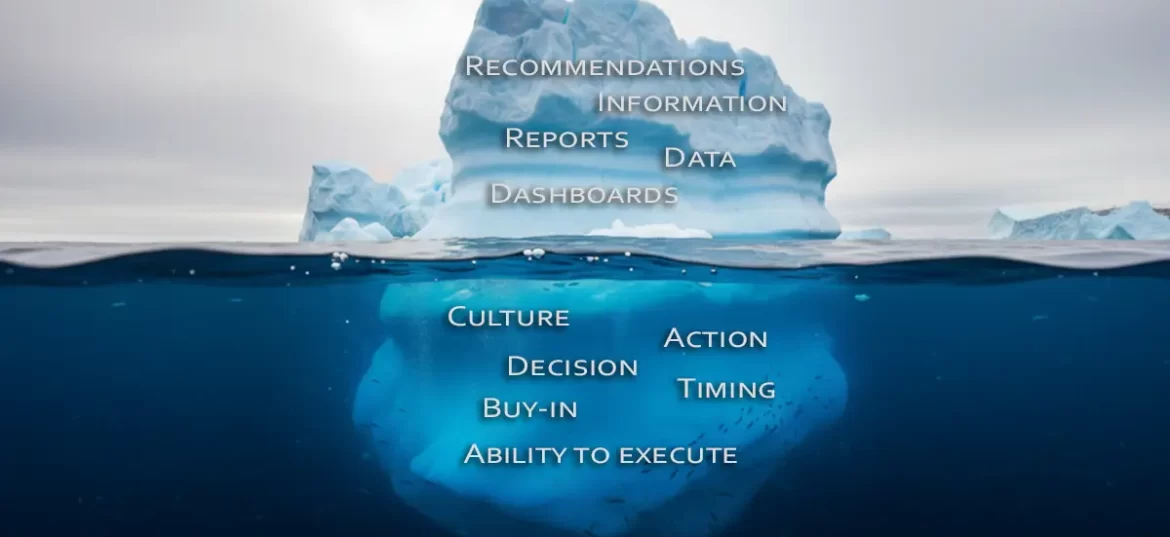

Market and Competitive Intelligence is one of the most powerful tools for reducing uncertainty and driving strategic decisions; however, to be effective, it is essential to overcome resistance, calibrate execution, and gain the trust of decision-makers.

Have you ever heard of an analytical technique called Indicator Monitoring? This Market and Competitive Intelligence (M&CI) method is used alongside Scenario Analysis to identify which projected scenarios are most likely to materialize

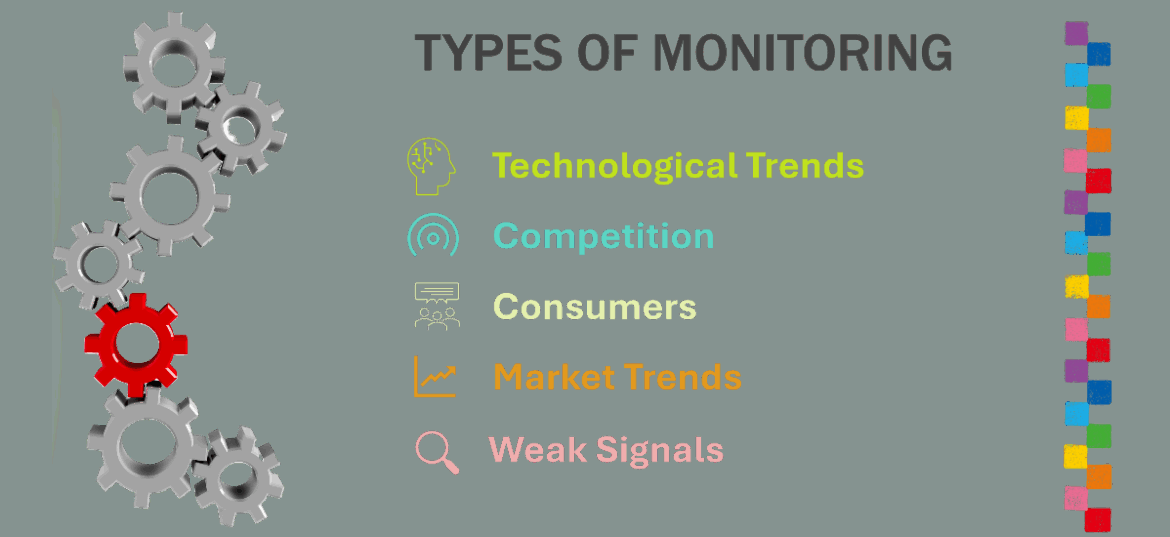

Many business leaders make the mistake of seeing markets as fixed scenarios. They only notice change when it hits their doorstep, disrupting the organization. That’s why forward-thinking companies invest in trend monitoring. Explore the five most common types of monitoring using market and competitive intelligence.

If your company is taking a reactive position in the market, falling behind the competition, or struggling to keep up with changes in the competitive landscape, it’s time to consider Market and Competitive Intelligence as a potential solution.

Heard of the silver economy? It refers to services and products for people over 70. Gen X, born from 1960 to 1980, is approaching this demographic milestone. They’ll be the first digitally-savvy generation to reach 70.