Tom Jobim’s quote “Brazil is not for beginners” has long been a mantra. This does not prevent experienced companies from acting like beginners. In the food retail sector, for example, several global competitors have tried to conquer the local market and given up.

The most recent example is the Spanish chain Dia, which is undergoing judicial recovery in Brazil. The giant Walmart abandoned the brand in the counrty and was acquired by Carrefour in 2022. The Mexicans from OXXO have also been in the red for several years.

There are, of course, several reasons for a business to be successful or unsuccessful. But in many cases, the keyword is “adapt.” Many companies try to apply in Brazil the model that worked in their country of origin or other parts of the world. And that doesn’t always work.

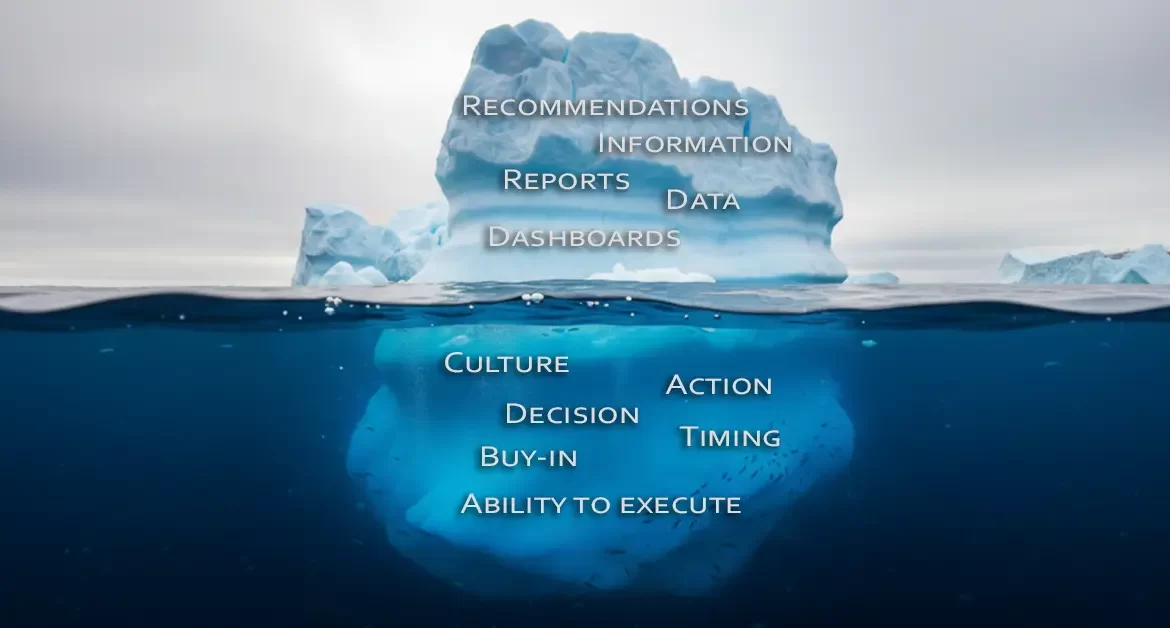

Market Intelligence and Competitive Intelligence can help

We have encountered such situations with our clients. Usually, after a few rounds of discussion around Competitive and Market Intelligence products, they become convinced that the local culture is different from the USA, Mexico, or Colombia.

Investing without knowing the local culture, rules, and habits is a recipe for problems. OXXO is a good example. The name is already difficult for Brazilians. It is pronounced “oh-kiss-so,” but everyone calls it “osho” anyway.

Operating 24 hours a day in Mexico, the chain had to adapt to Brazilian legislation. Most units in Brazil have only one employee during the night shift, so the store needs to close for one hour of mandatory rest. Some stores also faced security and loss issues with theft, as well as logistical difficulties for supply in downtown locations.

OXXO faces strong competitors like Carrefour Express, Pão de Açúcar Minuto, and Mini Extra (the last two brands of the GPA Group). The already struggling Americanas also operates a brand in the convenience store segment, Americanas Express. Four years ago, when OXXO introduced its brand in the national territory, Carrefour had already been operating conveniences for six years and Americanas for 17 years.

Shopping patterns and customer behavior

Another impactful factor for the convenience model is the food shopping pattern inherited from the times of hyperinflation. Many families do their weekly shopping in hypermarkets and more recently in wholesale stores. These are making good money and reporting high profits, especially the regional chains.

The fact is that a more in-depth study of local culture, laws, and shopping patterns would certainly have helped international players to devise more effective strategies for the Brazilian market. And it would increase the chances of success in a market that is highly attractive, after all it is the largest economy in Latin America.

✴︎ Don’t Waste Your Money

Learn more about our Intelligence services that

can help you to suceed in foreign markets