In the realm of Competitive Intelligence, one of the most intriguing techniques capable of yielding exceptional results is the analysis of weak signals. This technique is relatively advanced, demanding well-oiled processes for information monitoring and collection to function effectively. Additionally, it requires robust models to ensure accuracy and reliability. In essence, it represents an evolutionary step for any market intelligence function, whether in-house or outsourced to an external provider.

To reach this point of making decisions based on weak signal analysis, a company must possess a certain level of maturity in utilizing intelligence information within its decision-making process. After all, monkeys didn’t swing down from the trees one day and say, “Hey, let’s evolve and put one of us in space.” It takes time and effort to get there.

Implementing weak signal analysis is a gradual process.

The first step towards a sound weak signal system is having an already implemented monitoring system collecting information at a frequency that meets the company’s needs. At Link, we work with weekly, bi-weekly, or monthly frequencies. Anything longer than that doesn’t feed a weak signal analysis process effectively.

It’s crucial that this monitoring not be limited to sources available in automated monitoring systems, such as clippings, social media monitoring, or selective dissemination of information systems, even though they are essential for the overall process. To implement a robust weak signal analysis, intelligence monitoring must include primary sources. These can encompass:

Examples of Primary Sources

Sales team – can bring data on competitors and changes in purchasing habits obtained in the field, practically in real time

Procurement team – a conversation with a supplier can result in good information about competitors, logistics, and raw materials, for example

Researchers – a healthy relationship with academics and research institutions in the company’s field of activity opens the way for privileged information on new techniques, technologies, and R&D innovation

Analysts and experts – sometimes a market analyst, a journalist, or a columnist specializing in the segment can provide good insights into what’s going on

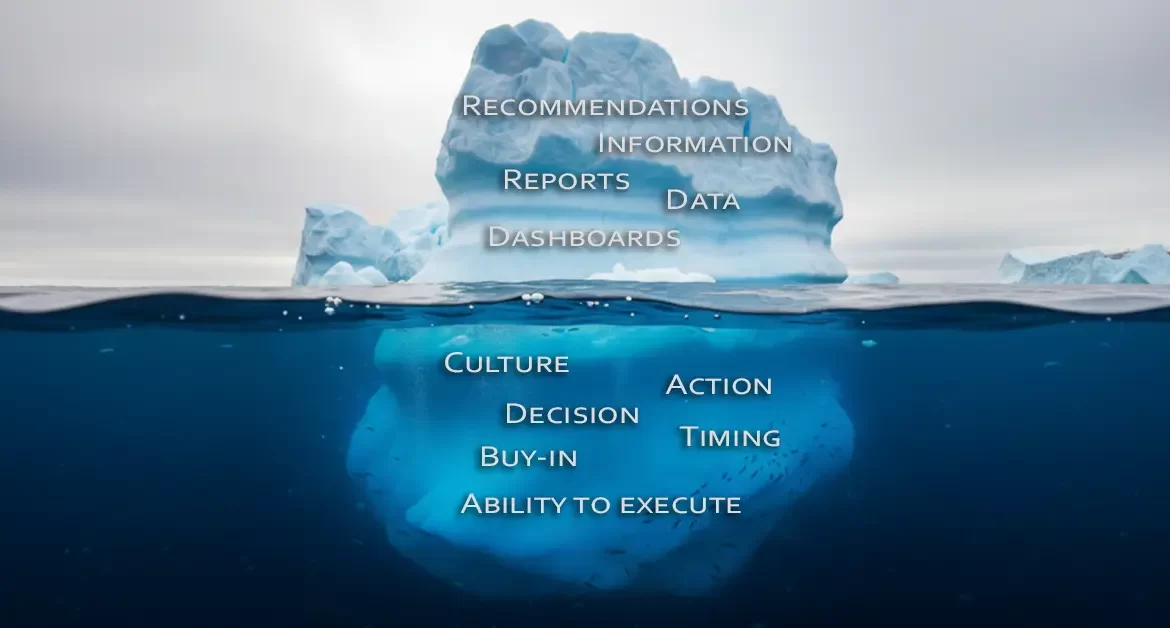

Credibility is Essential in Weak Signal Analysis

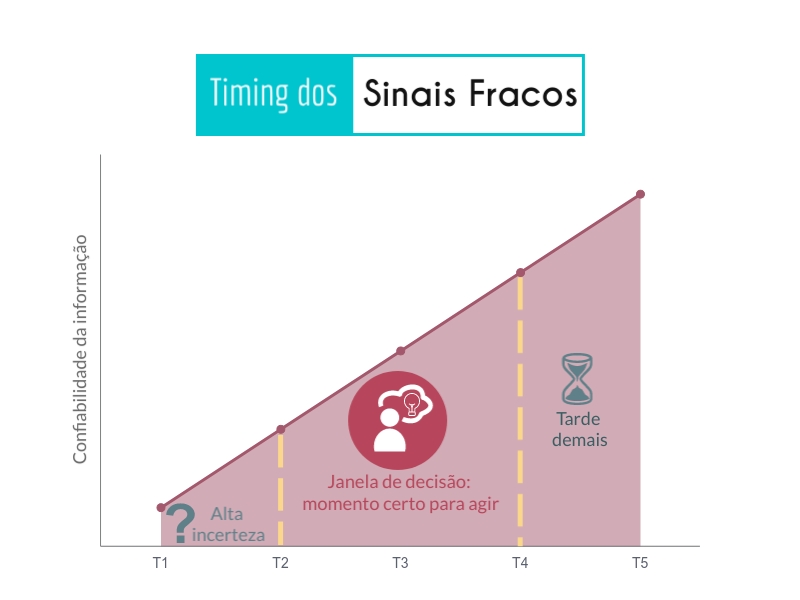

The importance of credibility is due to the degree of uncertainty that weak signal alerts carry with them. As the name suggests, the signal that something is going to happen or change is still weak. There is no 100% guarantee. If decision-makers wait for more certainty, information that confirms the way forward, the company may lose the timing of the decision and a competitor may get ahead. This calibration, of the degree of uncertainty that the manager is willing to accept, is given in part by the credibility of the CI team, whether it is internal or an external market intelligence provider.

Link clients with a more established partnership, engaging in four to five projects per year, demonstrate a significantly faster decision-making process when our team uncovers a weak signal. This is especially evident when compared to clients with a newer or less trusting relationship. The same accelerated decision-making can be observed in organizations with a well-established internal Intelligence team.

What is a weak signal?

To identify a weak signal, the most common procedure is to look for anomalies in the behavior of the business environment. If a certain piece of information does not indicate a known trend, there is a good chance that it indicates a weak signal. In this type of analysis, we are looking for elements that could be disruptive to the company’s competitiveness.

A method we use at Link is to identify the drivers of the competitive environment and from there parameterize the monitoring of weak signals. A company whose cost matrix is heavily dependent on raw materials, for example, needs to pay special attention to the factors that impact the value of inputs. In the case of manufacturers of manufactured products that use a lot of plastic parts, it is necessary to look at the prices of oil, naphtha, sugarcane, ethanol. A sharp change in the price of suppliers’ inputs can impact the price charged for plastic parts.

Once the drivers have been identified, we list the factors that impact these drivers. In the example above, the escalation of a conflict in a country that is a major oil producer, for example, could impact the value of naphtha. Or a prolonged drought in a sugarcane-producing region can affect the price of ethanol and, consequently, ethylene.

Each factor has a direct or inverse relationship with a driver. It may seem complicated – for those who have never done this type of analysis, it may be – but once the drivers, factors, and their relationships are established, it becomes much easier to keep an eye on the business environment. And much faster to observe the possibility of changes that impact the company. Thus, weak signal analysis is a powerful technique that allows companies to gain a competitive advantage and stay ahead of the competition.