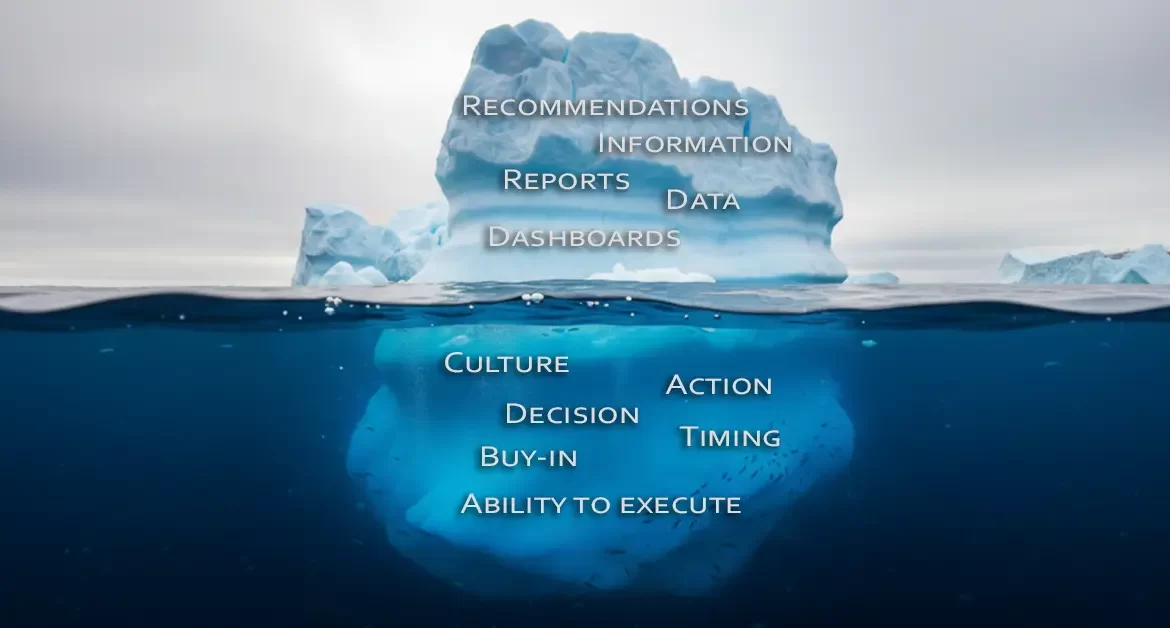

The initial stage of a Market and Competitive Intelligence (M&CI) process involves identifying the company’s information requirements. Link Estratégia’s methodology involves developing a chart with what we call Intelligence Needs.

This diagram outlines the company’s inquiries about its business landscape, encompassing future technologies, trends, and the current actions of customers and competitors. Nothing relevant to the future of the business can be left out.

Engaging with Decision-Makers

The Link team develops this map of the company’s information requirements by holding a seminar with key decision-makers – those who will use the intelligence analyses and reports internally. These sessions usually last a full day, or even longer for more complex industries. Under the guidance of Link’s analysts, decision-makers work in groups to identify relevant company topics and the questions surrounding each.

The process draws from Jan Herring’s intelligence needs identification method. In his article, Herring called these subjects Key Intelligence Topics (KITs).

After the workshop, analysts structure the Intelligence Needs chart, linking each topic and question from the decision-makers to key information sources, recommended analysis techniques, and deliveries that will fulfill the company’s intelligence needs.

The result is a set of spreadsheets and diagrams delivered to the company’s Intelligence department, enabling them to enhance their products and more effectively and efficiently meet the information needs of decision-makers.

Method Helps Organize the Intelligence Function

This consulting service is designed to refine the processes and activities of an established Intelligence function, or to guide the foundational steps in forming an in-house CI department or hub.

The diagram is sometimes used when engaging outsourced Intelligence services and market monitoring, both of which Link provides.

Golden rule: The sooner a Competitive Intelligence function starts delivering results, the better for everyone involved.

When Link supports the creation of a Competitive Intelligence department, hub, or team, we focus on achieving results. By using a proven and tested methodology – yet one that’s flexible and adaptable to the client company’s needs – the implementation process is faster, and the selection of tools, collection methods, and analysis techniques is more transparent.

Typically, this consulting approach starts with a diagnostic phase and with those involved in the demand for intelligence. Then it moves to identifying specific intelligence needs, establishing processes for data collection and monitoring, choosing appropriate software tools and analytical techniques, guiding the development and dissemination of intelligence deliverables, and ultimately, advising on the analysis and assessment of results.