With over 25 years of experience in Market and Competitive Intelligence (M&CI), we have had the privilege of serving companies across diverse sectors. This background has shown us that, despite differences in industries and corporate cultures, certain patterns consistently repeat.

We would like to share four lessons that have shaped our approach and, we hope, will help you extract more value from M&CI within your organization:

1. Decision-makers resist when data challenges their beliefs

At times, analysis points to a path different from what was planned. Mature leaders view this as a red flag: they review hypotheses, deepen the discussion, and courageously adjust course.

However, others cling to preconceived convictions and end up discarding evidence-based insights. We have witnessed these situations firsthand and, unfortunately, saw the cost of such choices unfold: strategies misaligned with market reality, missed opportunities, and underperforming results.

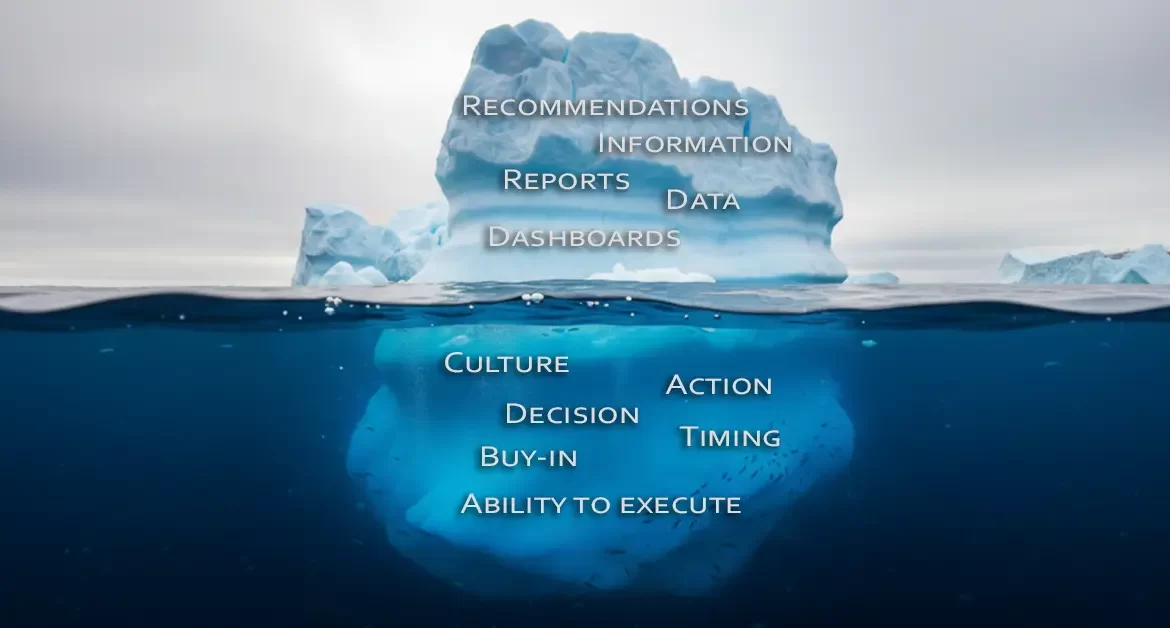

2. Recommendations do not become actions on their own

We recognize that it is not the role of M&CI teams to make decisions for managers. Nevertheless, it is frustrating to deliver robust analyses with clear, actionable suggestions only to see them stall.

In some cases, companies overestimate their execution capacity. They may want to enter a new market or launch a disruptive product but lack the structure, resources, or governance to do so.

In others, the issue is timing. The decision-making process is so slow that by the time action is taken, a competitor has already dominated the space or a disruptive product has completely shifted the landscape.

3. The best M&CI project is the one that is useful, viable, and on budget

When we present the full scope of what M&CI can achieve, many clients are eager for the “full package.” The danger lies there: overly ambitious projects that fall outside the company’s operational reality often exceed budgets or generate little actionable intelligence.

Because of this, we prioritize understanding the core need: which decision will be impacted and what time and resources are actually available.

4. Intelligence only creates value when understood (and internalized) by the right team

We have delivered countless analyses based on precise data, clear visualizations, and direct recommendations. Yet, in some cases, nothing happened. Why? Because those who needed to act did not buy-in on the information and analysis presented. Often, the mistake lies in treating M&CI as a report rather than a collaborative process.

That is why we involve stakeholders from the start: aligning Key Intelligence Questions (KIQs), co-creating hypotheses, and presenting insights in stages using accessible language. When a manager understands the “why” behind a conclusion from the beginning, they are not only more convinced but also feel empowered to act.

After so many years in the market, we remain convinced that Market and Competitive Intelligence is one of the most powerful tools for reducing uncertainty and driving strategic decisions. However, it only works when paired with humility, clarity of purpose, and the ability to execute.

✴︎ Discover How to Enhance your Market and Competitive Intelligence Projects

Leverage these tips to transform Intelligence into an effective strategic tool for your organization. Contact us to learn how we can help optimize your Intelligence processes. Don’t let your company fall behind.